Rural Payments Agency

Details

The application period

You may submit your application for a licence between 1 November 2023 and 5pm on 7 November 2023.

It is your responsibility to check that the application and all additional documentation is correct at the time of submission.

Note: We will reject any applications, securities or proof of trade received after 5pm on 7 November 2023.

Proof of trade

If this is your first application in the new quota year you will need to provide proof that you have imported at least 25 tonnes of fresh Garlic during each of the two periods:

- 1 March 2021 28 February 2022

- 1 March 2022 28 February 2023

You must provide a schedule giving details of:

- the licence number (if applicable)

- the date(s) of import

- the quantity imported

- the import entry number

You no longer have to supply endorsed copies of C88/CDS declarations.

Reference quantity

Your application will be based on a reference quantity. The reference quantity is the average quantity of fresh garlic imported in each of the two periods:

- 1 March 2021 28 February 2022

- 1 March 2022 28 February 2023

In the case of merged companies, you can combine the reference quantities of the companies forming the merger subject to satisfactory evidence being provided to RPA. Please see Annex III for procedures relating to merging companies.

Supporting documents

In addition to the above requirements, you must be established and registered for VAT in the UK. You must provide us with a copy of your current VAT registration certificate.

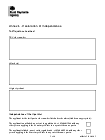

Declaration of Independence

You must provide a declaration of independence with the first application of the quota period which must contain:

-

a declaration that you are not linked with any other person applying for the same tariff quota

-

if you are linked with another person applying for the same order number, a declaration that identifies that linked person and evidence that you regularly engage in substantial economic activities with other third parties

Please see Annex II for specific requirements.

Licence applications

Your application submitted in any sub-period must not exceed 25% of your average reference quantity.

In box 8, the country of origin:

- you must enter China and state Yes as compulsory

In box 15, description:

- you must state Onions, shallots, garlic, leeks and other alliaceous vegetables, fresh or chilled: Garlic

In box 20, special particulars:

- you must state Statutory Instrument 2020 No. 1432 and Order Number as 05.4105

You must not lodge more than one import licence application for the same quota order number in the same application period.

Note: If you lodge more than one application for the same quota order number, all of your applications will be rejected.

Licence security

Applications must be accompanied by a security of 60 per tonne.

In box 11 you should state:

- the amount of security expressed in UKP ()

- the type of security, for example block guarantee, cash or single transaction guarantee

- the trader number of the block guarantee holder if you are using another traders block guarantee

Licence validity

Licences will be valid from 1 December 2023 until 31 May 2024.

Your licence will have a 5% upward tolerance. However, the reduction in duty will only be valid for the quantities shown in sections 17 and 18 of your licence.

As licences will only be valid for imports into the UK, your licence will be issued electronically. We no longer issue paper import licences.

Authority

You can find details of the arrangements in Statutory Instrument 2020 No. 1432. You can obtain copies from Stationery Office bookshops and accredited agents, or order from the Stationery Office website.

You can also access Statutory Instruments electronically by visiting the UKs Legislation website. The RPA is not responsible for the accuracy or completeness of the Legislation website. Whilst every care has been taken in producing this guidance, the Statutory Instrument as published is definitive.

Enquiries

If you have any questions about this notice, please contact the Trader team on:

Telephone helpline number 03300 416 500 (Option 1)

Email address trader@rpa.gov.uk

Our postal address is: Import Licensing Team

Rural Payments Agency

Lancaster House

Hampshire Court

Newcastle Business Park

Newcastle Upon Tyne

NE4 7YH

Annex 1

Tariff quota opened for imports of garlic from China falling within CN code 0703 2000

Origin | Order Number | Third sub period (December to February) | Fourth sub period (March to May) |

|---|---|---|---|

China | 05.4105 | 2,531,765kgs | 2,531,750kgs |

Annex 2

Declaration of Independence

An applicant is linked with another person if the applicant;

-

Has close business links with that person

-

Has family ties with that person

-

Has an important business relationship with that person

A person (A) has close business links with another person (B) if;

-

B is a parent undertaking of

-

B is a subsidiary undertaking of A

-

B is a parent undertaking of a subsidiary undertaking of A

-

B is a subsidiary undertaking of a parent undertaking of A

-

B owns or controls 25% or more of the voting rights or capital of A

-

A own or controls 25% or more of the voting rights or capital of B

For the purposes of the above, subsidiary undertaking and parent undertaking have the meanings given in section 1162 of the Companies Act 2006( a), read with Schedule 7 to that Act;

Having family ties with another applicant means that;

- The applicants are spouses or civil partners, or are living together as spouses or as if they were civil partners, or

- The applicant is the brother, sister, parent, child or grandchild of another applicant. Important business relationship includes a relationship where;

- The applicants are employer and employee,

- The applicants are partners in a partnership, or officers or directors in the same undertaking.

- Substantial economic activities means activities carried out by the applicant relating to the production, distribution or consumption of goods and services, which are not carried out for the sole purpose of applying for quotas.

Annex 3

Merger Process

Declaration of Independence

This quota will require a declaration of independence to be provided to support your application for a licence.