Tax And Revenue

0 articles

New Chief Economic Advisor to the Treasury appointed

Friday, 13 February 2026

Professor Brian Bell has been appointed as the new Chief Economic Advisor to the Treasury and Head of the Government Economic Service, replacing Sam B...

Minister Lloyd speech at techUK Future Telecoms Conference 2026

Friday, 13 February 2026

Liz Lloyd, Minister for the Digital Economy, spoke to techUK Future Telecoms Conference 2026 on 10 February 2026....

The government's response to the MAC's Seasonal Worker review

Thursday, 12 February 2026

On 23 March 2023, the MAC launched a self-commissioned review into the Seasonal Worker route and this is the government's response....

Record year of drug seizures made by Border Force

Thursday, 12 February 2026

Border Force and police seizures of ketamine and cannabis at all-time high and Border Force ramps up the return of foreign smugglers. ...

Minister Narayan AI speech at Founders Forum

Thursday, 12 February 2026

Kanishka Narayan, Minister for AI and Online Safety, spoke at Founders Forum on 10 February 2026....

Update on the procurement for Digital Gilt Instrument (DIGIT) Pilot

Thursday, 12 February 2026

The government has appointed HSBC as the platform provider for the Digital Gilt Instrument (DIGIT) pilot issuance following a competitive procurement ...

Two members appointed to the VisitEngland Advisory Board

Wednesday, 11 February 2026

The Secretary of State has appointed Richard Morsley and Rachel Walter as members of the VisitEngland Advisory Board for a term of five years...

George Bradshaw address 2026

Tuesday, 10 February 2026

The Transport Secretary sets out her vision for a reformed railway that's run by the public, for the public. ...

U.S. UK Transatlantic Taskforce Hosts Industry Engagement in London

Tuesday, 10 February 2026

HM Treasury hosted representatives from the U.S. Treasury and regulatory agencies in London to conduct joint industry engagement on the Transatlantic ...

CMA secures commitments from Apple and Google to improve fairness in app store processes and enhance iOS interoperability

Tuesday, 10 February 2026

Commitments would deliver immediate improvements to the way UK developers publish apps and how they access Apple’s tools....

Community energy investment to build community wealth and power

Monday, 09 February 2026

Biggest ever public investment in community energy will cut bills and create revenue for community centres, social clubs and places of worship....

Government publishes Budget Information Security Review

Monday, 09 February 2026

Government has today published a review with recommendations to protect information security at future fiscal events....

HMRC introduces?GOV.UK?One?Login for new customers?

Monday, 09 February 2026

HMRC introduces GOV.UK One Login....

Communities set to benefit from fairer funding

Monday, 09 February 2026

Fairer funding as part of the Final Local Government Financial Settlement will help to tackle deprivation and improve public services ...

Claim your Child Trust Fund this National Apprenticeship Week

Monday, 09 February 2026

Young people encouraged to claim their Child Trust Fund savings for financial head start...

Landmark agreements secured after first UK China Financial Working Group in Beijing

Friday, 06 February 2026

British jobs and businesses to be supported by enhanced cooperation with China in financial services...

How UK Government is building a stronger future for Scotland's farmers, crofters and rural communities

Thursday, 05 February 2026

Minister's speech to National Farmers' Union Scotland's conference highlights UK Government's commitment to industry, as forum explores growth opportu...

New Green Book to ensure that investment in all parts of the UK given a "fair hearing"

Thursday, 05 February 2026

New guidance will support fairer and more balanced decisions on investment in every part of the country....

Landscaping boss ignored director ban and racked up £300,000 in unpaid tax across two companies

Thursday, 05 February 2026

Director banned for 12 years...

Act now: 864,000 sole traders and landlords face new tax rules in two months

Thursday, 05 February 2026

More than 860,000 sole traders and landlords need to start using digital tax reporting from 6 April....

Government to unlock advanced nuclear to grow economy

Wednesday, 04 February 2026

Government publishes Advanced Nuclear Framework to get pioneering nuclear technology off the ground....

11.48 million beat the Self Assessment deadline

Tuesday, 03 February 2026

Millions of taxpayers filed their Self Assessment tax return for the 2024 to 2025 tax year by the deadline....

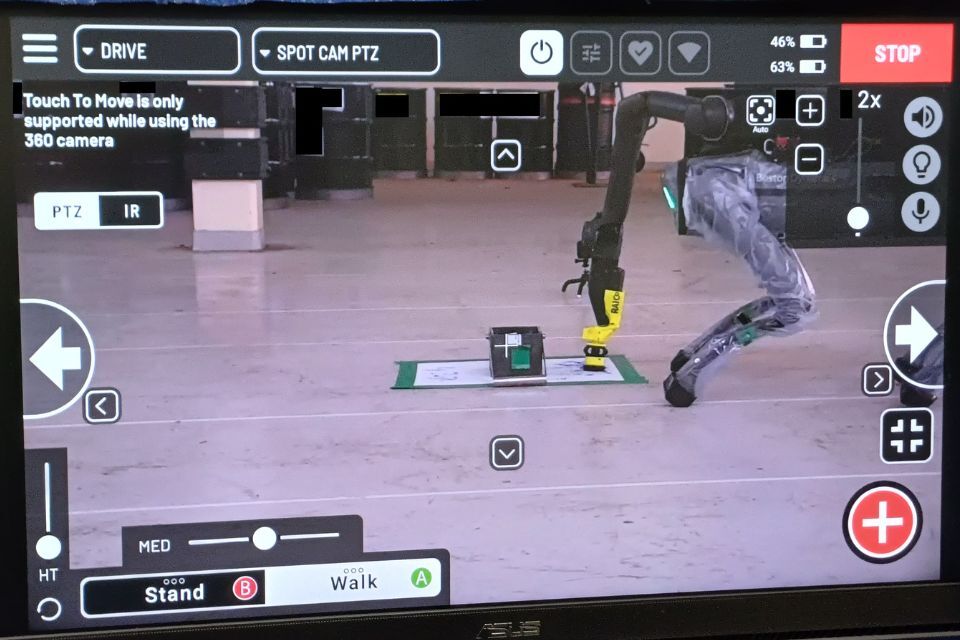

New robot swabbing technology trialled for the first time at Sellafield

Tuesday, 03 February 2026

Sellafield’s Remote Technologies Group is the first to use an innovative contamination swabbing tool for quadruped robots, developed through the RAICo...

Government to cover travel costs of children with cancer

Tuesday, 03 February 2026

£10 million financial support package for families of children and young people with cancer to cover travel costs to and from appointments....

Update on 'Do’s and Don’ts' of incorporating a CIC online

Sunday, 01 February 2026

We’ve identified the most common mistakes for each document you need to submit and compiled a list of Hints and Tips to get you on your way, whether a...

West Midlands Trains services transferred

Sunday, 01 February 2026

West Midlands Trains services are now managed by DfT Operator Ltd (DFTO)....

Billions in exports and investment deals secured as PM concludes visit to China

Friday, 30 January 2026

Billions of pounds worth of?export?and?investment?deals for the UK have been secured, as the Prime Minister wraps up his visit to China....

London Northwestern Railway and West Midlands Railway services return to public ownership

Friday, 30 January 2026

From 1 February 2026, passengers who travel with London Northwestern Railway and West Midlands Railway will benefit from reliable and better-connected...

The facts show Russia’s victory in Ukraine is far from inevitable: UK statement to the OSCE

Thursday, 29 January 2026

UK Counsellor, Ankur Narayan, sets out the escalating human, economic and military costs of Russia’s invasion, explaining why a Russian victory is far...

MHRA issues new guidance for people using mental health apps and technologies

Wednesday, 28 January 2026

New online resources will help the public, parents, carers and health, social care and education professionals understand what safe, effective digital...